To begin, if we needed to give the yr 2025 a headline, it might learn, “Market pushed by tweets.” As we noticed throughout Trump’s earlier administration, market fluctuations went hand in hand along with his prolific tweeting on the social community X, and we consider this pattern will proceed, particularly now that the proprietor of X, Elon Musk, is a part of his crew.

We are going to listing the factors that we take into account basic one after the other:

- Significance of geopolitics: This isn’t a brand new figuring out issue this yr, however it’ll proceed to play a significant function. Geopolitical conflicts transfer the market. Entrenched conflicts such because the Armenia-Azerbaijan battle over Nagorno-Karabakh, Syria and the autumn of the Al Asad regime and the brand new regime, the proxy battle in Yemen between Saudi Arabia and Iran (which put in danger probably the most necessary oil export routes – the Strait of Hormuz). Israel and the delicate ceasefire in Gaza; Israel is a powerful ally of the US, however particularly of the Republicans, which can additional strengthen its place within the area. Conflicts enhance the potential for breaking provide chains. Conflicts which have been simmering for years and others generated for political acquire will set the tempo for market fluctuations within the coming months.

- The Russia/Ukraine struggle: Though it would not make headlines, the struggle continues and with it all of the dangers it entails for the grain commerce. Though for all events (Russia, Ukraine, and the European Union) it has been vitally necessary to keep up the grain commerce, which is why exports have continued regardless of the struggle since 2022, the dangers implicit in a battle zone live on, such because the breakage of the export settlement, value will increase, or freight value will increase because of the threat of cargoes within the battle zone. However, it additionally stays to be seen how the struggle will evolve, and the function that the US (the main financier to this point of Ukraine) will play in it for the reason that Republican authorities doesn’t appear to be in favor of financing the struggle. It’s conceivable {that a} cease-fire might be pressured. In a state of affairs the place either side are exhibiting nice put on and tear (each economically and in casualties), Trump’s look could favor a truce or ceasefire. If this settlement had been to incorporate the discount of sanctions towards Russia by the EU, this might favor a drop in grain costs.

- China and Trump’s tariff insurance policies: He has not bored with repeating that he considers the present productive distribution with China unfair and detrimental to the pursuits of the US, so a commerce struggle is imminent. Inserting tariffs on Chinese language merchandise (he has even spoken of imposing 100% tariffs) will provoke China to behave accordingly by inserting tariffs on American merchandise. The Chinese language economic system continues to decelerate and, though the federal government has to this point been capable of keep the markets through stimuli, it isn’t clear whether or not they are going to be sufficient to affect the markets in 2025, particularly given the belligerence proven by the U.S. authorities in direction of China. Though it has damaged uncooked materials import data, making ready for Trump’s arrival in authorities, if China stops shopping for uncooked supplies typically, it’ll drive uncooked materials costs downwards.

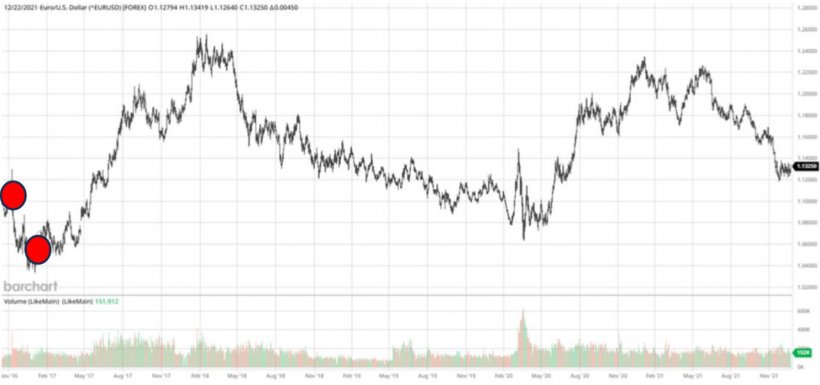

- Euro/Greenback: The forex performs an necessary function. Trump and his authorities are in favor of a weakened forex that enables the export of products, which in flip favors reindustrialization and home consumption, briefly, they help protectionist insurance policies. Let us take a look at a graph of his earlier authorities: the primary level corresponds to election day on November 8, 2016, and the second to when he was sworn in as president on January 21, 2017. As seen within the graph, the insurance policies they inspired favored the devaluation of the greenback right down to 1.257 €/$. The devaluation of the greenback will favor the competitiveness of U.S. grain and soybean costs in all markets.

Supply: barchart.com

- Excessive climate phenomena: In recent times, the proliferation of maximum climate occasions affecting crops, both when it comes to yields, which in flip cut back manufacturing, or their high quality, has additionally turn out to be an everyday incidence. This issue stays a excessive threat for 2025.

- EUDR implementation: The implementation of the European regulation towards deforestation has been delayed till December 30, 2025, for big firms, pushing again a regulation that’s tough to implement and that provides a big administrative burden to firms. However it has not been canceled, merely in a number of months, we will relive the groundhog yr for 2026 purchases.

- Lack of management within the European Union: The EU lacks sturdy and clear management, which it wants if it desires to play a predominant function on the planet. We consider that, out of necessity, within the face of a authorities in the US the place the connection with Europe isn’t a figuring out political issue, a management that favors higher union could lastly seem. Extreme paperwork is without doubt one of the EU’s weaknesses within the quick time period, within the face of the change within the guidelines of the sport posed by 2025. Much less regulation would favor commerce in grains and oilseeds, and even profit the emergence of competitors.