The UK pig breeding herd is forecast to develop barely this yr, whereas pigmeat manufacturing stays regular on 2024 ranges, in keeping with AHDB’s 2025 Pork Outlook.

The outlook, which will be considered right here, additionally forecasts continued stress on export markets attributable to geopolitical tensions and a small lower in general pork poroduct gross sales volumes in 2025.

Pork manufacturing

UK clear pig slaughter volumes are forecast to achieve 10.32 million head in 2025, a slight lower of 0.1% in comparison with 2024, whereas common carcase weights are anticipated to stay at round 90kg, in step with earlier years.

That is anticipated to end in general UK pigmeat manufacturing of 960,000 tonnes, simply 0.1% under the 2024 determine. Small year-on-year progress is predicted in Q1, Q2 and This fall, however Q3 is predicted to see a 1.2% year-on-year decline as a result of excessive manufacturing volumes in Q3 2024.

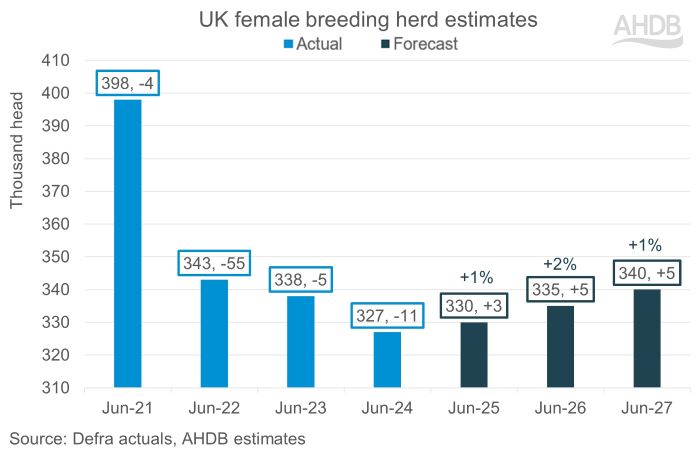

Regardless of improved trade sentiment, a lot of producers continued to exit the trade via the primary half of 2024. This in the end led to a 3.1% decline within the UK feminine breeding herd on the Defra June census.

In contrast, H2 introduced reviews of on-farm investments, rising demand at genetic companies and a few intentions to up pig numbers. Nevertheless, in opposition to this, the Autumn Finances created uncertainty, dampening sentiment at yr finish, which is being carried into this yr.

On this foundation, AHDB is forecasting a slight enhance of simply 1% within the UK feminine breeding herd to 330,000 in June 2025. It continues to anticipate solely minor modifications within the dimension of the breeding herd past this yr, with numbers in 2027 forecast as much like these recorded in 2023. This can be depending on internet margins remaining in a constructive place, the outlook doc provides.

Regardless of these comparatively small modifications, productiveness enhancements have been a driving pressure within the sector. AHDB’s quarterly estimated value of manufacturing has seen a slight lower over the course of 2024, however they’ve nonetheless contributed to constructive trade sentiment and common internet margins of £15 per head. Nevertheless, ongoing uncertainty, together with financial challenges and fluctuating prices, continues to impression producer confidence, particularly as some producers exit the trade, the report cautions.

Commerce

The outlook for commerce in 2025 is blended, with geopolitical tensions and market volatility persevering with to have an effect on UK exports. Export volumes are anticipated to be down by 1% year-on-year as decrease shipments to the EU and USA outweigh positive factors in different markets.

The EU stays the UK’s most vital buying and selling accomplice, with over 99% of UK pig meat imports and over 42% of exports coming from the area. Nevertheless, demand from the EU is predicted to lower as EU consumption weakens.

Regardless of these challenges, there are brighter prospects in markets like Southeast Asia, the place African Swine Fever (ASF) has impacted native manufacturing. The relisting of two UK processing websites for China and the potential for stronger commerce ties with nations like South Korea might assist offset weaker demand from conventional markets.

The outlook predicts that UK imports will bew up by 1% over the yr, pushed by worth differential between UK and EU and sturdy demand in foodservice sector. It notes that consensus amongst merchants is that FMD in Germany will trigger minimal impression on UK imports, as a result of patrons will supply from elsewhere inside the EU

Home demand

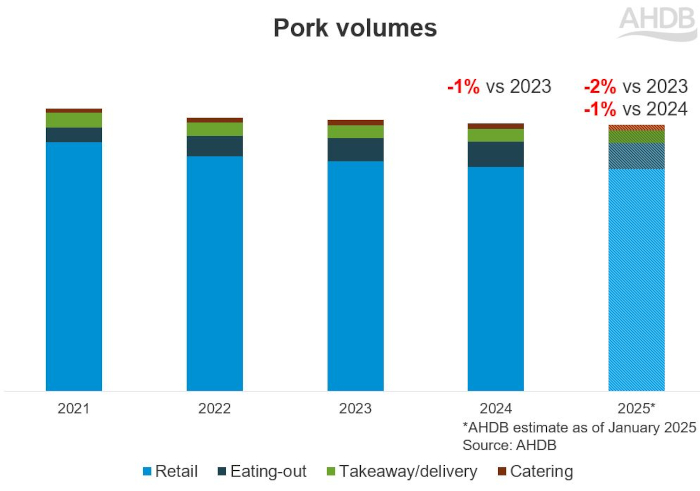

In 2024, UK retail demand for pork fell by 2.4% year-on-year in keeping with Kantar (52 w/e 29 December 2024). The foodservice market carried out higher, with volumes up by 5.5% (AHDB estimates based mostly on Kantar out-of-home information).

The outlook predicts Retail demand for pig meat is more likely to stay underneath stress in 2025 attributable to financial challenges and fluctuating shopper perceptions across the well being credentials of pork.

Nevertheless, the continued progress of the foodservice sector, notably in eating out and on-the-go meal events, presents a precious alternative. Customers are searching for inexpensive, handy meals, with pork well-suited to fast, tasty choices akin to sandwiches and savoury pastries.

Because of this, general pork volumes for 2025 are anticipated to lower by 1%, in comparison with 2024.

Vanessa Adamson, AHDB Retail & Client Perception Supervisor, mentioned: “As we proceed to face financial pressures, selling the dietary advantages and flexibility of pork can be key in encouraging shoppers to include extra pork into their meals. With elevated curiosity in inexpensive meal choices and a rising foodservice sector, there are vital alternatives to develop pork consumption, notably via handy merchandise like sausages, burgers, and pre-prepared cuts.”

To boost the outlook for pork consumption in 2025, trade gamers are urged to concentrate on speaking the well being advantages of pork, akin to its wealthy vitamin and protein content material and promote versatile recipes, batch cooking concepts, and inexpensive meal choices will assist seize shoppers’ curiosity. Premium cuts of pork also needs to be marketed as indulgent, treat-worthy choices to enchantment to these searching for high-quality, cost-effective eating experiences, the outlook provides.

Costs

Home pig costs will proceed to face stress from falling EU costs via Q1 2025, with the brand new yr beginning at a file worth differential of 44p. Trying additional forward, costs might see some stability if no vital modifications are seen in enter prices, sustaining value of manufacturing, the reviews predicts.

It provides that world politics and commerce dynamics can be a key affect on pricing traits in 2025, alongside the potential impression of illness outbreaks.

Freya Shuttleworth, AHDB senior analyst (livestock), mentioned: “Whereas the pork market faces challenges akin to fluctuating export demand and rising geopolitical uncertainties, we’re seeing indicators of resilience.

“The continued progress of the foodservice sector and rising shopper curiosity in value-driven cuts of pork supply potential areas for optimism. The trade’s focus should stay on assembly the evolving wants of shoppers whereas sustaining excessive requirements of welfare and sustainability.”