Everlasting reductions welcomed however sector pushes for extra

On July 27, the Argentine authorities carried out everlasting reductions in export taxes for a number of main agricultural merchandise, in response to a latest USDA International Agricultural Service report.

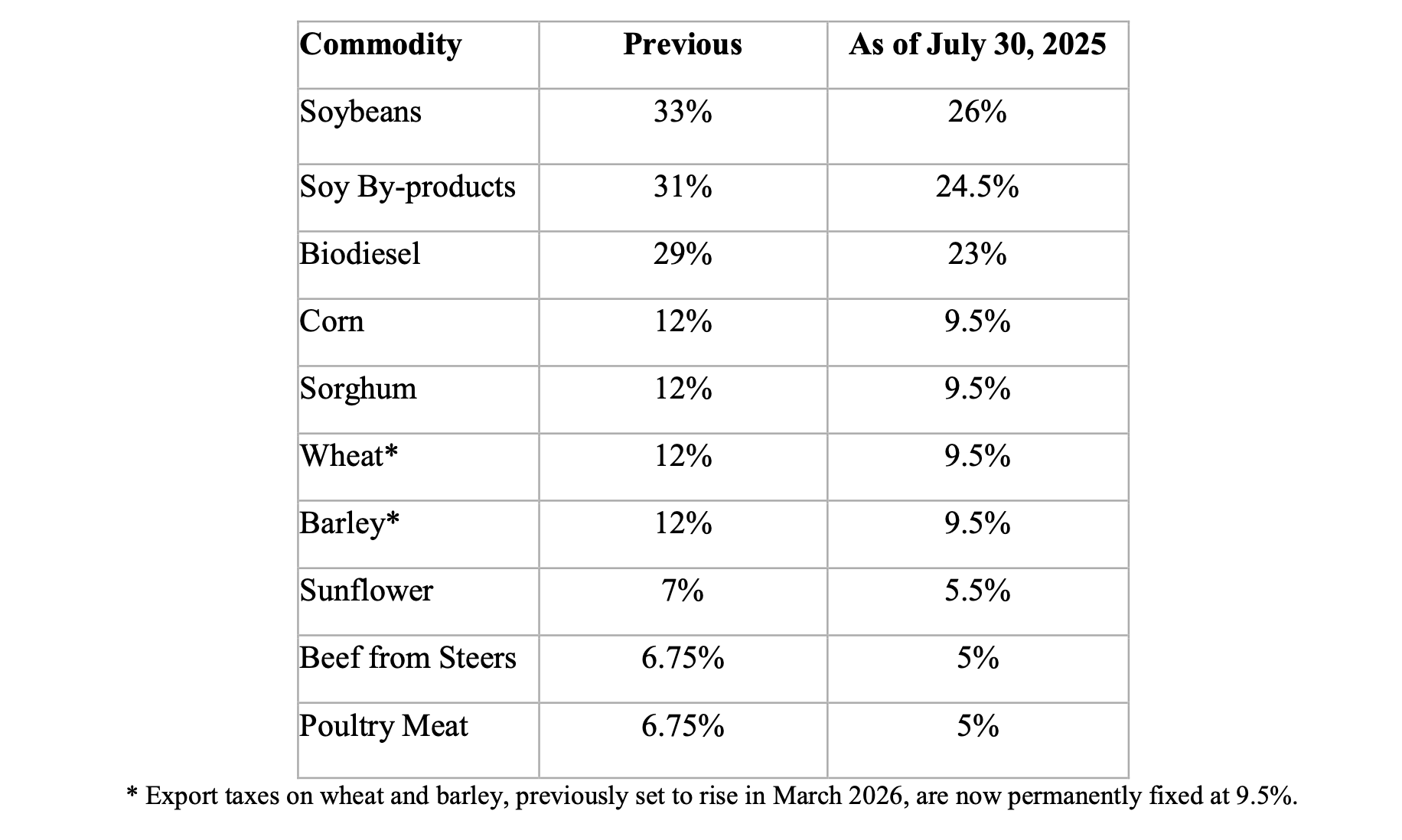

The soybean fee was lowered from 33% to 26%, corn and sorghum from 12% to 9.5%, and soybean by-products from 31% to 24.5%. In contrast to earlier momentary cuts, these modifications take impact instantly upon publication within the Official Bulletin to stay in place throughout the present administration and symbolize an enduring coverage shift.

Whereas the reductions had been welcomed by the agricultural sector, trade teams proceed to advocate for deeper or whole elimination of export taxes. The influence on manufacturing and exports is anticipated to be restricted within the quick to medium time period.

On July 27, President Javier Milei introduced a everlasting discount in export taxes on key agricultural merchandise throughout his deal with on the 137th Expo La Rural, the most important livestock and agricultural occasion within the nation, organized by the Sociedad Rural Argentina in Buenos Aires.

The reductions apply to a broad vary of agricultural exports, together with grains, oilseeds, processed oilseed merchandise, poultry, and beef. In response to the announcement, these measures. Regardless of earlier momentary reductions in some export taxes, that is the primary time such cuts have been made everlasting. The decrease tax charges will stay in place throughout President Milei’s administration however a change of events in future administrations may reverse the cuts. The present charges as printed within the Official Bulletin are as follows:

As well as, the federal government made everlasting the present 9.5% export tax charges on wheat and barley, which had been beforehand scheduled to return to 12% in March 2026.

President Milei attributed the tax reductions to the federal government’s just lately achieved fiscal surplus following years of macroeconomic instability characterised by a number of alternate charges, excessive inflation, capital controls, and burdensome rules.

The announcement comes amid mounting stress from agricultural producers, who’re going through tight or unfavourable margins as a consequence of weak international commodity costs and persistently excessive home manufacturing prices in US greenback phrases. Producer associations have lengthy argued that export taxes, recognized domestically as retenciones, scale back competitiveness and discourage funding.

The sector has largely welcomed the reductions as a constructive step, although many proceed to advocate for the entire elimination of export taxes within the quick to medium time period.

Put up expects the measures to enhance farm and ranch profitability, as producers will retain the income beforehand paid in export taxes on the affected commodities listed within the desk above. Nonetheless, given present market situations, they’re unlikely to lead to a big improve in total grain or livestock manufacturing within the close to time period.