The quantity of UK pork exports within the first quarter of 2025 elevated by 4% yr on yr, pushed by increased volumes to China.

A complete of 77,800 tonnes of pigmeat was exported within the first three months of 2025, with all product classes besides bacon recording quantity progress.

Shipments of offal stay the biggest contributor to the export basket at 36,700t (47%), with nearly all of this product (22,100t) despatched to China. Regardless of quantity to China rising by over 3,000t (18%), total class progress, up 4%, was extra muted shipments to the Philippines fell by over 1,000t (26%).

Recent and frozen pork exports grew yr on yr for the primary time since 2022, up 2,000t to 32,900t in Q1. Though the EU27 is the primary vacation spot for this product (48%), progress within the class was pushed by elevated shipments to China.

The upper volumes heading to China has little doubt been helped by the return of China export licences to 2 main UK pork crops in December.

Exports of bacon have been steadily declining for the final couple of years, with Q1 2025 volumes again 5% in comparison with the identical interval final yr. 97% of this product goes to the EU27 with the decline pushed by Eire and Germany. Quite the opposite shipments of processed pig meat have been selecting up (1%) with Eire the important thing vacation spot, in line with AHDB senior analyst Freya Shuttleworth.

Imports:

In distinction, pigmeat import volumes, at 180,500t, fell by 1%, 1,800t, in Q1. Bacon was the one class to file progress, up 3% year-on-year to 42,600t, whereas recent & frozen pork held regular at 77,500t, persevering with to carry the biggest market share (43%). Nonetheless, declines in processed pig meat and sausages of 1,300t every drove the general development.

Influence of FMD in Europe:

The affirmation of foot and mouth illness (FMD) in Germany on January 10 initially had a major affect on commerce flows.

“The UK noticed important year-on-year decline in each imports (-8%) and exports (-13%) of pig meat that month as Germany misplaced its export licence to the UK, leading to extra product availability inside the European market and extra strain on pig costs. Nonetheless, commerce volumes in February and March picked up as provide chains tailored to the brand new provide base,” Ms Shuttleworth mentioned.

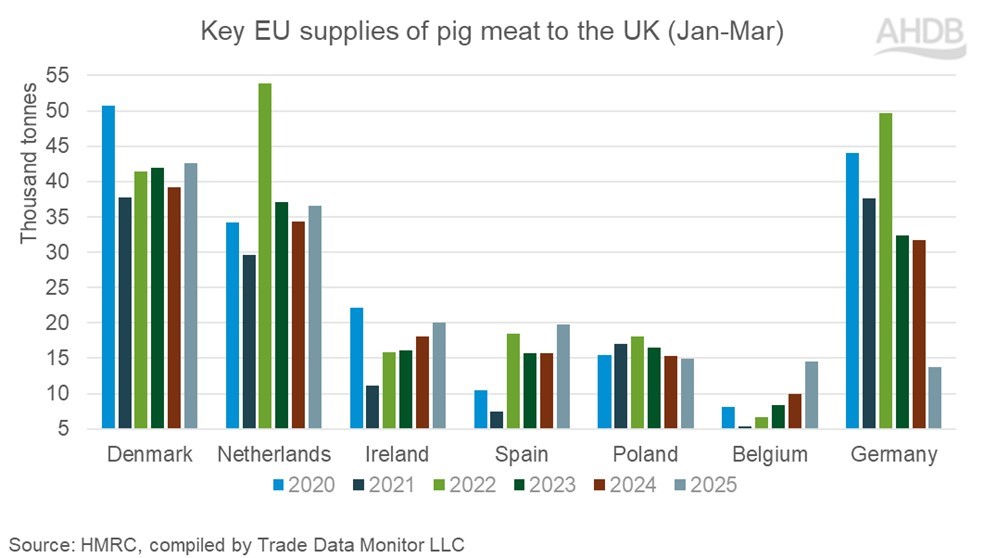

The EU27 accounts for over 99% of pig meat imports to the UK. During the last 5 years (2020-2024) Germany has been continually within the high 3 commerce companions, with Q1 shipments averaging 39,100 t. This can be a stark distinction in comparison with 2025, the place Q1 quantity reached simply 13,800 t, putting Germany because the UK’s seventh largest provider, she added.

Altering provide bases have meant important quantity will increase from different key buying and selling companions. Belgium, Spain and Denmark have seen volumes up 4,500t, 4,200t and three,300t on the yr respectively, whereas the Netherlands and Eire have recorded a rise of round 2,000t every.

Germany was granted regionalisation by the UK authorities on March 24, permitting commerce from exterior the containment zone to renew. As of 14 Might, Germany is recognised as FMD free with out vaccination by the UK, that means all commerce restrictions related to the illness have been formally eliminated.