One of many foremost goals of the settlement is to get rid of nearly 90% of tariffs between each events, progressively over 10 years, with some exceptions that can prolong as much as 15 years. It’s price clarifying that, though the settlement has already been signed, it’s nonetheless topic to the ratification course of by the European establishments and the nationwide parliaments of the member states, so this course of might take a number of months and even years.

The settlement will considerably affect pork and, as anticipated, has provoked divided opinions amongst swine business representatives in each areas. Whereas some view it as a chance, others contemplate it a threat as a result of regulatory and financial imbalances.

Present context of the worldwide pork commerce for the events

Earlier than analyzing the settlement’s results on our business, we have to contextualize the present state of pork commerce in each blocs. To this finish, the next is a short evaluation of each events’ worldwide commerce volumes and flows.

European Union

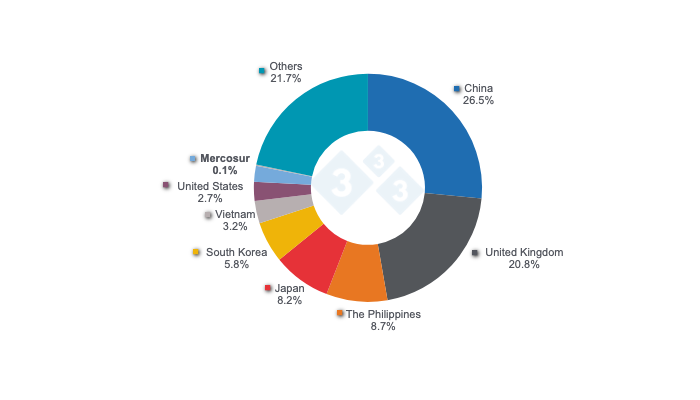

The EU stands out because the main exporter of pork globally, adopted by the US and Brazil. In 2024, the EU exported a complete of 4.35 million tons of pork merchandise. Final yr, its foremost locations had been China and the UK, whereas Mercosur accounted for simply 0.17% of the general whole (Determine 1).

Graph 1. Prime locations for EU pork exports in 2024, together with information for MERCOSUR. Supply: 333 based mostly on Eurostat information.

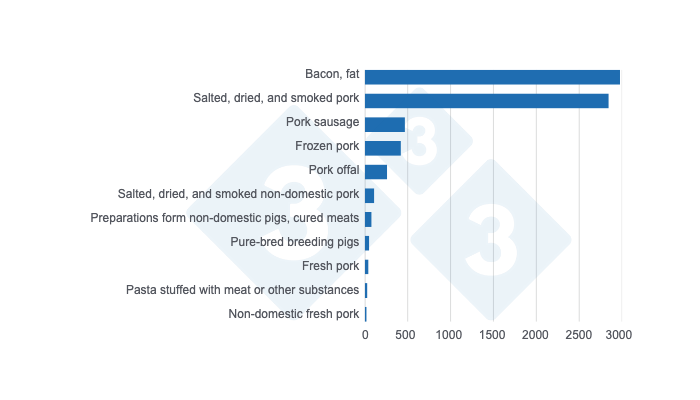

Relating to shipments to Mercosur nations, the main locations had been Uruguay (3453 t, 47% of whole exports to Mercosur) and Brazil (2979 t, 41%), and to a lesser extent, Argentina (861 t, 12%), and Paraguay (17 t, 0.2%). The merchandise the EU provides to Mercosur are typically value-added, akin to salted and smoked merchandise, though there are additionally important shipments of pork fats (Determine 2).

Graph 2. Exports of pork merchandise and by-products from the European Union to MERCOSUR in 2024, in tons. Supply: 333 based mostly on Eurostat information.

As for pork imports, the amount is minimal. In 2024, the EU imported 160,947 tons, largely from the UK (67%). Of the entire, solely 25 tons got here from the nations that make up Mercosur, accounting for simply 0.02% of EU pork imports. Notably, Brazil performed a big position, representing 64% of Mercosur’s whole exports to the EU, with 16 tons.

Mercosur

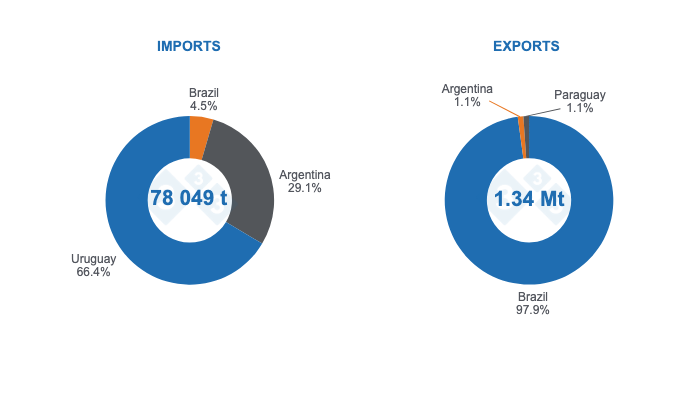

Though Mercosur refers to a bloc made up of Brazil, Argentina, Paraguay, and Uruguay, it is very important point out the marked variations between these nations, for the reason that benefits and downsides of the settlement might have a special affect on every member nation. The next is a short description of the worldwide pork commerce for every nation:

- Brazil, the biggest nation in Latin America, is the world’s fourth-largest pork exporter. In 2024, it noticed file pork exports, which exceeded 1.3 million tons, 30% of which had been despatched to China. Brazil is at present licensed to ship its pork to greater than 89 nations, with 90% of its exports equivalent to pork cuts. As for shipments to the EU, these characterize only one% of the general whole, whereas imports from the EU are additionally minimal and correspond to salted and smoked objects.

- Argentina is a rustic with nice potential; the truth is, lately it has skilled a change in insurance policies which have permeated the macroeconomic surroundings, together with a big discount in inflation and the fiscal deficit, in addition to the elimination of boundaries to worldwide commerce. As for swine manufacturing, in 2024, pork manufacturing grew 3% and reached 785,000 tons, whereas imports final yr noticed a year-on-year progress of 38% with 22,000 tons, of which 95% got here from Brazil and the remaining 5% from nations akin to Chile and Paraguay. Pork exports elevated by 30% final yr, reaching nearly 30,000 tons. Argentina at present has 41 licensed export locations for pork exports.

Graph 3. Worldwide pork commerce in MERCOSUR for 2024 and participation of member nations. Supply: 333 based mostly on information from Comexstat, SAGyP, OPYPA, and ACCP.

- Regardless of being a really small nation geographically, Paraguay has nice export capability. In 2024, it exported greater than 15,000 tons of pork, with Taiwan being its foremost buying and selling associate with 64% of pork exports. It additionally has a robust dynamic in Mercosur intraregional commerce, with 17% of its exports within the final yr going to Uruguay, 12% to Brazil, and 4% to Argentina. Probably the most exported merchandise are frozen pork (72%) and casings (17%).

- Uruguay’s home consumption is comprised of 80% imported pork. Its foremost suppliers of frozen pork are exactly Mercosur nations, Brazil (96%) and Paraguay (2%), whereas fats imports come primarily from Spain (36%), Chile (19%), and Paraguay (18%).

Challenges and alternatives of the settlement, events’ perceptions

The potential of this negotiation for the swine business is big. Along with reworking and considerably rising pork commerce between the 2 areas, it has the capability to generate necessary exchanges in areas akin to expertise switch, animal welfare, and sustainability, particularly from the EU to Mercosur, additionally attracting giant investments.

Then again, the EU may gain advantage by rising its market share in Latin America and getting access to uncooked supplies at a comparatively low value, since Brazil and Argentina are two of the world’s main producers of corn and soybeans.

Now let’s take a more in-depth have a look at the potential results for the events.

European Union

Throughout the EU, the consequences of the settlement might be completely different for every Member State as they are going to rely on components such because the construction of their manufacturing, their export orientation, and their dependence on uncooked supplies.

Total, the opening of this new market could not characterize a big change when it comes to export quantity, since, as talked about above, Mercosur has sturdy pork manufacturing and consolidated intra-regional commerce. The place there may very well be progress alternatives is within the export of excessive value-added merchandise. European processed meat, cured sausages, and different pork merchandise are globally acknowledged for his or her high quality and custom. Till now, exports of those merchandise to Mercosur have been restricted as a result of excessive tariffs and commerce boundaries. With the settlement, the discount or elimination of those tariffs might facilitate entry to Mercosur customers, particularly in premium markets and sectors with excessive buying energy, which search merchandise differentiated in style, high quality, and sanitary certifications.

Nonetheless, this opening additionally entails dangers for European producers. Mercosur is a extremely aggressive area when it comes to manufacturing prices, as a result of components akin to entry to cheaper uncooked supplies (primarily soybeans and corn for animal feed), decrease environmental and animal welfare rules, and decrease labor prices. This raises issues throughout the European swine business, which already operates below strict regulatory requirements and faces profitability challenges.

On this regard, though the settlement maintains the EU’s excessive sanitary, welfare, and sustainability requirements intact, it might generate unequal competitors between European and Mercosur producers as a result of structural variations in manufacturing prices and inside rules. The applying of safeguard clauses, the reinforcement of controls on compliance with sanitary and sustainability requirements, in addition to the implementation of certifications aligned with European requirements, might be key facets to keep away from a damaging affect on EU pig farming.

One other side to contemplate is the provision of uncooked supplies. Soybeans, the primary agricultural product that the EU imports from Mercosur, together with its derivatives (soybean meal and oil), already enter the European market with zero or very low tariffs within the case of derivatives. Nonetheless, given the EU’s excessive dependence on these imports, the settlement may gain advantage European livestock by guaranteeing a extra secure provide to be used in feed manufacturing.

Mercosur

Though Mercosur theoretically features as an financial bloc, a assessment of the particular traits of the pork market in every member nation reveals important variations. From Brazil’s giant quantity and number of export locations to Argentina’s sturdy potential and stable infrastructure, Paraguay’s export-oriented strategy, and Uruguay’s reliance on imports to fulfill home demand. On this sense, the consequences and advantages of the settlement with the EU might be very completely different for every nation.

As well as, intra-regional commerce in Mercosur may be very dynamic within the swine business, as mentioned earlier. This attribute might restrict, to some extent, the entry of EU pork, since Mercosur has a sturdy and aggressive intraregional provide and glad demand. Nonetheless, the EU might enhance its exports of processed merchandise akin to salted and smoked merchandise, entry to which is at present restricted as a result of excessive prices, proscribing consumption to a choose group of customers. The entry of those duty-free merchandise would contribute to diversifying the gastronomic provide in a tradition that, though very conventional, is in search of new meals choices.

Then again, Mercosur’s alternatives to enter the EU with pork and pork by-products might stimulate the growth of pig farming and the expansion of native manufacturing destined solely to cowl this new buying and selling associate. Nonetheless, though the Mercosur product could be extra aggressive in concept when it comes to price-cost ratio, there are non-tariff boundaries that may drastically restrict entry to this market. Amongst these boundaries are strict rules on essential points akin to animal welfare, sustainability, labeling, and biosecurity. At current, even the massive producers in Mercosur nations are solely starting to take the primary steps towards complying with these requirements.

This raises an necessary query: Is it sufficient for Mercosur producers to adapt their farms and manufacturing techniques to the European Union’s excessive requirements, pushed primarily by the inducement of market entry? Or are authorized agreements and national-level rules additionally wanted to fulfill these requirements and harmonize necessities for each side? This can be a main concern, particularly from the attitude of the imbalance that might come up, given the strict rules imposed on European producers in comparison with the present regulatory framework in Mercosur nations.

One of many potential future penalties of the implementation of this settlement in Mercosur may very well be the transformation of the swine business within the area, pushed by the EU’s superior rules. These rules might not directly contribute to reshaping the pig manufacturing mannequin and contribute to the adoption of technological improvements, genetic enhancements, sustainable practices, and different facets through which the EU is superior and about which Mercosur nations nonetheless have a lot to study. Because of this settlement, joint tasks may very well be developed that may permit the switch of information, leading to business development.

Desk 1. Parallel challenges, dangers, and alternatives of the pork commerce between the European Union and Mercosur, derived from the settlement.

EUROPEAN UNION

|

MERCOSUR

|

|

|---|---|---|

| OPPORTUNITIES |

|

|

| CHALLENGES AND RISKS |

|

|

| FUTURE SCENARIOS |

|

|

Supply: 333