Total trade efficiency in 2024

To offer context, let’s take a look at the outcomes of the important thing variables and the standout traits of the area’s 5 main nations, which account for practically 95% of complete manufacturing quantity. Prior to now yr, they consolidated 9.1 million tonnes (Mt), reflecting a 1.9% development in comparison with 2023.

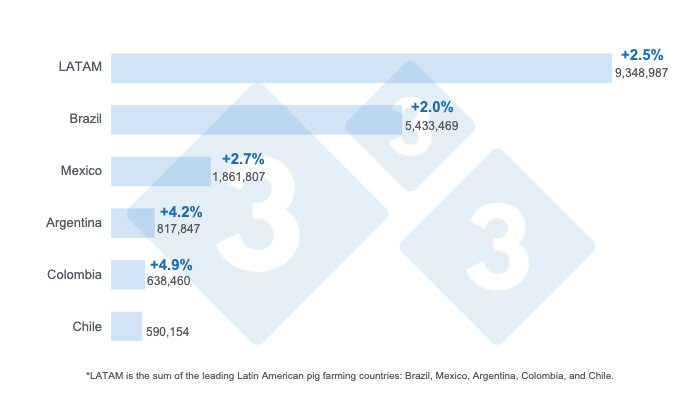

Graph 1. Pork manufacturing in 2024 for main Latin American nations and regional complete, annual variations. Ready by 333 Latin America with knowledge from IBGE, SIAP, SAGyP, Porkcolombia, and ODEPA.

Brazil’s pork exports reached report highs (1.3 Mt), up practically 10%, suggesting excessive competitiveness in supplying worldwide pork demand. Nevertheless, this enhance in exports appears to have contributed to a lower in home consumption, regardless of a slight 1.1% enhance in pork manufacturing, which reached 5.3 Mt in 2024.

Though Mexico’s home manufacturing elevated by 2.5%, reaching 1.8 Mt, it depended considerably on pork imports, which had been provided primarily by america. Imports reached report highs once more (1.73 Mt) and represented practically 52% of home pork consumption. Exports fell by 12% and reached 188,629 t. Nevertheless, the rise in export costs helped mitigate the drop in quantity.

In Argentina, home consumption was the principle driver of development in pork manufacturing, which reached 785,049 t, a 3% enhance in comparison with 2023. Regardless of the macroeconomic challenges and the vigorous enhance in imports totaling 22,674 t, home manufacturing grew considerably, supported partly by a gradual restoration in exports, which grew by 30.2% within the final yr.

Colombia continued to guide pork manufacturing development within the area with an annual enhance of seven.8% and a report quantity of 608,752 tons, which moved it as much as fourth place within the rating of Latin American pork producers, displacing Chile to fifth place. Colombia’s outlook for the swine trade may be very optimistic, as sustained development is anticipated within the quick, medium, and long run.

Lastly, Chile’s home pork consumption recovered, supported by a slight enhance of 0.5% in pork manufacturing and a major enhance in imports (18.1%). The two.1% lower in exports additionally suggests a deal with assembly home demand, which returned to ranges above 448,000 t, a determine not reached since 2022.

What can we count on in 2025?

Graph 2. 333 LATAM projections for pork manufacturing in 2025 within the main Latin American nations and the regional complete. Figures in tons and estimated proportion development with respect to 2024. Ready by 333 Latin America with personal knowledge.

On the regional stage, we count on pork manufacturing to proceed to develop to succeed in 9.3 Mt in 2025, in keeping with our estimates. Nevertheless, we are going to face a serious shock from the imposition of tariffs on pork by america, which may reshape worldwide commerce flows and even home manufacturing ranges, so we must adapt to a brand new market actuality.

Brazil is as soon as once more anticipated to see vital development in its pork exports, because of the competitiveness of its product, in addition to to the greater than 89 nations which have licensed Brazil as their provider of imported pork. Moreover, the present “tariff struggle” between america and several other of its conventional buying and selling companions may current nice alternatives to broaden this Latin American big’s participation as a pork provider to nations resembling Mexico and China, amongst many others. Subsequently, in keeping with our estimates, pork manufacturing would attain 5.4 Mt, supported by larger demand, each domestically and overseas, all year long.

Mexico could be considerably affected by the imposition of tariffs by america, its fundamental provider of imported pork, and by the retaliatory measures adopted by its nationwide authorities. In view of this, we may foresee two potential situations, the primary of which might be the diversification of its industrial companions to substitute, partly, what would not be imported and exported to and from america, or additionally, an import substitution plan could possibly be applied, growing home pork manufacturing – though the outcomes of this could not be instant and would solely be seen in the long run. One factor we’re certain of is that home demand for pork in Mexico may be very robust and home consumption is rising steadily. So, there’s a massive market ready to be served both by imports or home manufacturing. Now, in keeping with our projections, home pork manufacturing in Mexico for 2025 could be round 1.7 Mt. Considering the share of imports in home consumption, about 1.8 Mt could be wanted from overseas to cowl home consumption.

In Argentina, as the assorted authorities measures that affect the macroeconomic surroundings and worldwide commerce proceed to take impact, the outlook for the swine trade is anticipated to proceed to enhance. On this regard, we estimate pork manufacturing near 820,000 t in 2025 and count on a gradual restoration of exports. We should additionally take note of the energy of home pork consumption in Argentina, given its competitiveness in comparison with different proteins, which is why the quantity of imports may expertise a substantial enhance to produce the rising home demand.

In Colombia, we count on the swine trade to proceed to carry out very properly and to proceed to broaden, attaining a better market share because of elevated consumption. We additionally estimate that manufacturing will once more set a report, reaching round 640,000 t in 2025.

Lastly, for Chile, we forecast manufacturing of 590,000 t, with a slight enhance of 0.8% in comparison with 2024. Swine farming will proceed to be overshadowed by adopting new environmental rules, which might enhance manufacturing prices for compliance and in addition restrict the rise in manufacturing.

Conclusion

2024 was a really constructive yr for Latin American pork manufacturing. The robust demand for pork continued to be pushed by home consumption and allowed for a major quantity of imports, with out considerably undermining native productions. Likewise, there was proof of latest escalations and incursions of Latin American pork into world markets, which is a transparent signal of the competitiveness of our pork exports; there may be nonetheless a protracted option to go on this facet, however we’re heading in the right direction.

In 2025, our sector will proceed to develop whereas dealing with main challenges. As soon as once more, the geopolitical surroundings apparently performs towards us. Nevertheless, I’m satisfied that each disaster leads immediately or not directly to a brand new alternative and maybe this potential reconfiguration of commerce flows could possibly be an incentive to additional diversify provide and demand interactions with new buying and selling companions and even to extend our native manufacturing.