Falling feed prices drove a wholesome enhance in common internet pig farm margins in the course of the second quarter of 2025, in keeping with the newest replace from AHDB.

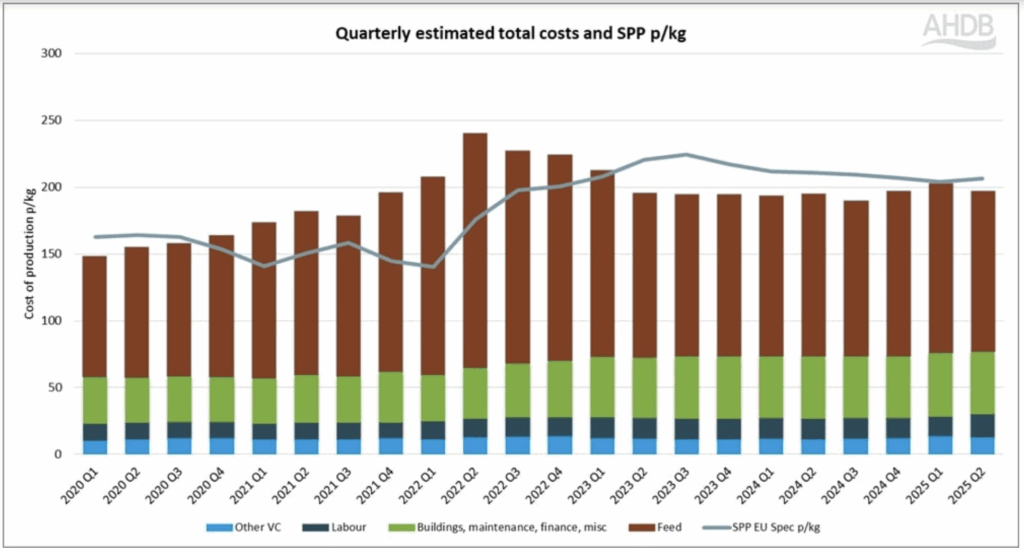

Q2 feed prices fell by 7p to 120p/kg, making up an estimated 61% of complete prices. Common feed prices hit a excessive of 175p/kg throughout Q2 2022, accounting for 73% of complete prices, however since Q2 2023, have ranged between a extra manageable 116-127p.

Finance prices and gas costs additionally fell throughout Q2 – nonetheless, this was offset by a rise in labour prices.

The AHDD estimates, which use efficiency figures for breeding and ending herds, put the complete financial value of manufacturing for Q2 2025 at 197p/kg deadweight, 6p beneath the Q1 determine.

In the meantime, pig costs, as measured by the SPP, elevated by 2p throughout this quarter to round 206p/kg (SPP). This resulted in margins of £8.10 per slaughter pig and 9p/kg deadweight.

This was up from simply £1/head in Q1 2025 and according to the This autumn 2024 determine. There have now been 9 consecutive quarters of optimistic margins, following the ten consecutive quarters of debilitating losses that have been estimated to have value the business in extra of £700 million.

From the beginning of 2025, the price of manufacturing and internet margin figures have been calculated utilizing the SPP value as a substitute of the APP because it has been continued, which ends up in barely decrease reported margins.

The SPP has continued to rise slowly because the begin of Q3, whereas feed prices have remained comparatively low, suggesting pig farmers will stay, on common, comfortably within the black.