This dynamic is altering the standard flows between producing international locations. France, Denmark, and the Netherlands are adjusting their exports to adapt to market developments.

Spanish imports

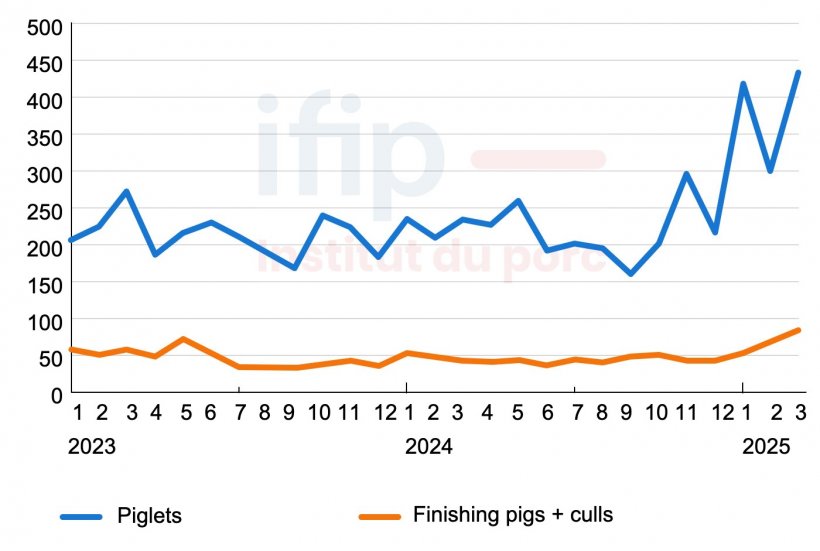

Spain’s imports of dwell animals considerably elevated within the first quarter of 2025. The European chief is more and more resorting to dwell animal imports attributable to persistent sanitary issues (PRRS) and overcapacity in its slaughterhouses and slicing crops. As well as, the excessive costs on the Spanish market favor elevated dwell pig flows to southern Europe. Within the first quarter, piglet imports soared by 76% in comparison with 2024, reaching 1.1 million head. Purchases of ending pigs and cull pigs additionally elevated (+43%), totaling 62,900 animals.

Spanish month-to-month imports of dwell pigs (thousand head). Supply: IFIP primarily based on Eurostat information (customs).

The Netherlands continues to be Spain’s primary provider of piglets, with 835,000 head exported within the quarter (+81% year-on-year). As for ending pigs, Belgium shipped 66,400 animals (+707%) and France shipped 25,500 animals (+711%). For financial and structural causes, Portugal maintains a gradual move of dwell pig exports to Spain. These shipments intensified at the start of the 12 months (+112%) and reached 62,800 head.

French exports enhance

France’s exports of ending pigs elevated by 41.5% throughout the first three months of 2025, reaching 89,500 head. Regardless of this enhance, these flows stay marginal. Every month, ending pig exports account for lower than 2% of home slaughter. In March, for instance, 30,500 ending pigs had been exported to the EU. The principle locations had been Belgium (+2.7%) and Spain (+711%). As for piglets, French exports had been minimal (2,200 head within the first quarter).

Northern Europe reorganizes its dwell pig commerce

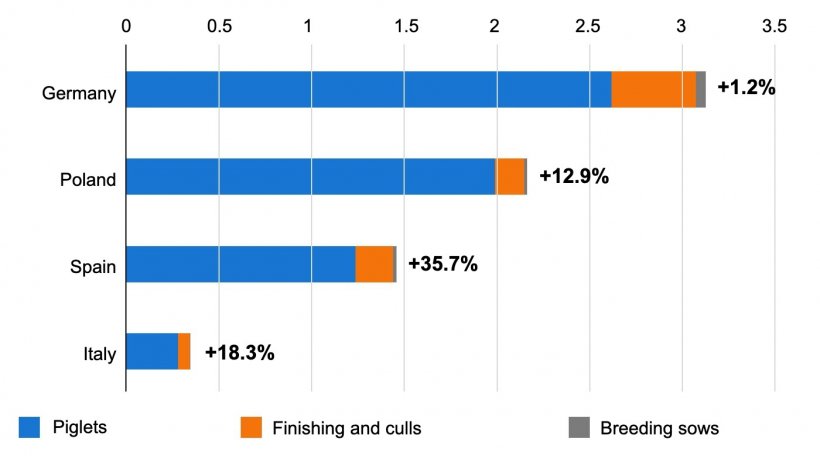

In northern Europe, the restructuring of pig manufacturing chains lately has led to a shift in dwell animal flows. Since 2020, German demand has fallen sharply, forcing the diversion of Danish and Dutch dwell pigs to different locations. Since 2024, the German market has been within the means of rebalancing, however the look of a case of foot-and-mouth illness in early January in Germany quickly disrupted the dwell pig commerce within the space. Within the first quarter, German pig imports decreased once more (-1.6%), particularly between January and February, a interval throughout which restriction zones and limitations had been imposed on the transport of dwell animals.

In Denmark, gross sales of dwell pigs elevated by 3% within the first quarter of 2025, primarily within the piglet class. Piglet exports grew to the German (+1.1%) and Polish (+13.4%) markets.

Within the Netherlands, the home market has seen a marked discount in its pig provide in current months. Slaughter fell by 7.7% throughout the first 4 months of the 12 months in comparison with the earlier 12 months. The restructuring of the slaughtering sector within the north of the EU and worth variations on the European degree are altering commerce flows. As well as, the continuation of presidency insurance policies aimed toward encouraging the cessation of livestock farming is reinforcing the autumn within the provide of ending pigs, a dynamic that’s prone to proceed within the coming months within the Netherlands. Thus, piglet exports elevated by 18%, whereas ending pig exports fell by 19%. This dynamic in piglets is especially pushed by Spanish demand, whereas shipments to Germany are down attributable to transport restrictions related to foot-and-mouth illness detected at the start of the 12 months.

European importers of dwell pigs within the first quarter of 2025 vs. 2024 (million head). Supply: IFIP primarily based on Eurostat information (customs).

Thus, European pig commerce information affirm that Spain’s import dynamics continued throughout the first quarter. Alternatively, dwell animal flows proceed to be polarized in the direction of Germany. Regardless of the sanitary disturbances that occurred at the start of the 12 months, the German market stays a significant importer, with 3 million pigs imported. As compared, Spain imported 520,000 head throughout the first quarter. Lastly, exports from France, the Netherlands, and Denmark proceed to develop, though with contrasting dynamics relying on the variety of animals concerned, the kind of pig, and the associate international locations.

Elisa Husson,

Economist ‘Place des Marchés’ by IFIP