Livestock analyst Jim Wyckoff stories on world pig information

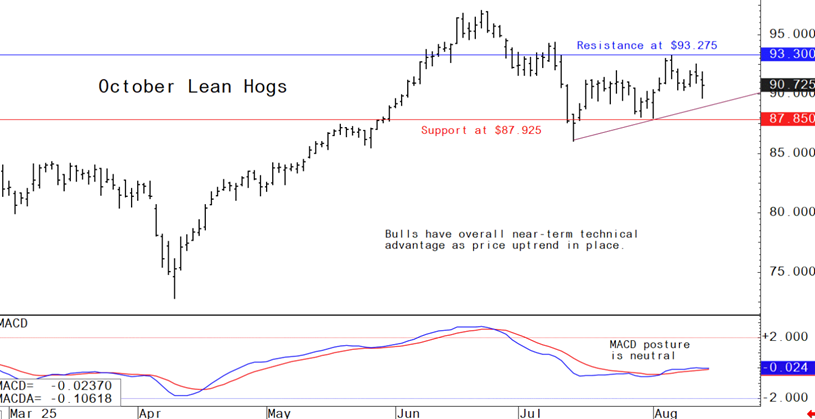

The lean hog futures market Wednesday noticed some profit-taking strain amid fading money fundamentals and a stable decline in pork cutout worth this week. The most recent CME lean hog index is down 23 cents to $110.02 as of Aug. 8. Thursday’s projected money worth is down 6 cents to $109.78. The nationwide direct five-day rolling common money hog worth quote Wednesday was $108.99. The lean hog futures bulls are retaining alive a worth uptrend on the day by day chart for August futures. Nonetheless, bulls want to indicate contemporary energy quickly.

Weekly US pork export gross sales report

Pork: Web gross sales of 21,200 MT for 2025 had been down 32 % from the earlier week and 19 % from the prior 4-week common. Will increase primarily for Japan (6,500 MT, together with decreases of 100 MT), Mexico (4,700 MT, together with decreases of 600 MT), South Korea (3,500 MT, together with decreases of 100 MT), Colombia (1,700 MT, together with 100 MT switched from Guatemala and reduces of 100 MT), and Honduras (1,200 MT), had been offset by reductions for Hong Kong (100 MT). Exports of 27,000 MT had been down 4 % from the earlier week and 1 % from the prior 4-week common. The locations had been primarily to Mexico (13,200 MT), Japan (3,500 MT), South Korea (2,300 MT), China (2,200 MT), and Colombia (1,400 MT).

USDA Month-to-month livestock report

LIVESTOCK, POULTRY, AND DAIRY: The forecast for 2025 pink meat and poultry manufacturing is diminished from final month. Beef manufacturing is lowered on diminished fed and non-fed cattle slaughter and lighter dressed weights. Pork manufacturing is diminished reflecting official knowledge reported via the primary half of the 12 months, in addition to a slower slaughter price and diminished dressed weights within the third and fourth quarters.

The pork export forecast for 2025 is raised primarily based on official knowledge reported via June and no adjustments are made to 2026 pork exports. The broiler export forecast can be raised for 2025 primarily based on knowledge via June and is unchanged for 2026. The turkey export forecast for 2025 is raised on knowledge via June and better exports for the third quarter. The 2026 turkey export forecast is unchanged. Cattle worth forecasts for 2025 are raised for each the third and fourth quarters primarily based on current worth energy and resilient demand for beef. The upper cattle worth forecasts are carried into 2026.

The 2025 hog worth forecast is raised primarily based on current costs, with will increase persevering with into 2026 on tighter pork provides. Broiler worth forecasts for 2025 are diminished for the second half of the 12 months primarily based on current worth declines via early August, with diminished costs carrying into subsequent 12 months.

Smithfield boosts 2025 revenue outlook on sturdy meat demand

Smithfield Meals posted quarterly gross sales of $3.79 billion for the interval ended June 29, an 11% improve from a 12 months earlier. Adjusted earnings rose to 55 cents per share from 51 cents final 12 months. The corporate now expects 2025 adjusted working income between $1.15 billion and $1.35 billion, up from its prior forecast of $1.10 billion to $1.30 billion. Within the second quarter, packaged meat gross sales climbed 6.9%, whereas contemporary pork gross sales superior 5%. Smithfield attributed the good points to strong demand for merchandise equivalent to bacon and contemporary pork cuts, with extra shoppers selecting to dine at residence.

US Court docket upholds EPA livestock emissions exemption

Decide says 2018 legislation helps company’s determination to not require disclosure

The US District Court docket for the District of Columbia on Aug. 7 upheld an EPA rule exempting livestock operations from reporting poisonous air emissions, discovering it aligned with congressional intent below the 2018 Truthful Agricultural Reporting Methodology Act. Decide Timothy Kelly mentioned the rule was a “simple studying” of the legislation and in keeping with many years of interpretation below CERCLA and EPCRA.

What’s subsequent: Environmental teams, which argued the exemption violated EPCRA by shielding ammonia and hydrogen sulfide emissions from disclosure, haven’t but determined whether or not to enchantment.

Past Meat misses Q2 targets

Plant-based meat maker cites weak U.S. demand and world uncertainty

Past Meat reported second quarter internet revenues of $75 million, down 19.6% from a 12 months in the past and properly beneath Wall Avenue expectations. Gross revenue dropped to $8.6 million (11.5% margin), in comparison with $13.7 million (14.7%) in Q2 2024. The corporate blamed mushy U.S. retail demand, weak worldwide foodservice gross sales, and losses from exiting its China operations. “We’re dissatisfied with our second quarter outcomes,” mentioned CEO Ethan Brown, attributing the miss to ongoing softness within the plant-based meat class. Elevated client worth sensitivity continues to weigh on different protein gross sales.

China strikes to chop pig numbers amid glut

Trade to curb overcapacity and stabilize hog costs

China’s hog business will meet in Beijing subsequent week to debate reducing breeding sow numbers by 1 million, in line with a discover seen by Reuters and first reported by Bloomberg. With the nationwide sow herd at 40.43 million — properly above the optimum 39 million — the transfer goals to ease oversupply and stabilize money hog costs, which have dropped to beneath 14 yuan/kg from round 20 yuan a 12 months in the past. The assembly will even goal speculative “secondary fattening” practices and implement stricter slaughter weight controls.

U.S. meat export snapshot – June 2025

Pork rebounds sharply; China lockout drags down beef shipments

U.S. pork exports surged in June, serving to offset earlier-year losses and ending the primary half of 2025 on a powerful word, in line with knowledge launched by USDA and compiled by the U.S. Meat Export Federation (USMEF). Nonetheless, beef exports slumped to their lowest stage in 5 years, largely because of China’s failure to resume most U.S. plant registrations. Lamb exports posted good points from 2024 however noticed their weakest month-to-month efficiency of the 12 months.

Pork Exports Rebound

- June whole: 239,304 mt (+7% YoY) valued at $682.6M (+3.5% YoY)

- Prime market: Mexico — $250M (second highest on report)

- Development areas: Central America, Colombia, Caribbean, Vietnam

- Selection meats: +10% YoY, boosted by shipments to China

- H1 2025: 1.46M mt (–4% YoY); $4.11B (–3.5% YoY; third highest on report)

“We anticipated a June rebound for pork,” mentioned USMEF CEO Dan Halstrom, citing eased commerce tensions with China.

The following week’s probably high-low worth buying and selling ranges:

October lean hog futures–$87.825 to $93.275 and with a sideways-higher bias

September soybean meal futures–$280.00 to $300.00, and with a sideways-higher bias

December corn futures–$3.85 to $4.11 and a sideways-lower bias

Newest analytical day by day charts lean hog, soybean meal and corn futures