The most recent AHDB Porkwatch survey confirmed regular retail assist for British pork in the direction of the tip of 2024.

Throughout the ten retailers surveyed in November, 88% of the pork on show was British, in contrast with 87% in September and 89% in November 2023.

Aldi, Co-op, Lidl, M&S, Morrisons and Sainsbury’s all recorded 100%, with Waitrose on 96%, together with 100% British on personal model. Tesco was on 78% British and Asda, 59%, down from 68% a 12 months in the past, and Iceland simply 1%.

A complete of 55% of bacon on show was British, barely up on September and a 12 months in the past, with Co-op and M&S on 100% and Waitrose 94%. On the different finish of the size, Tesco stocked simply 36% British, with Asda on 26%, Aldi 21%, Lidl 17% and Iceland 14%.

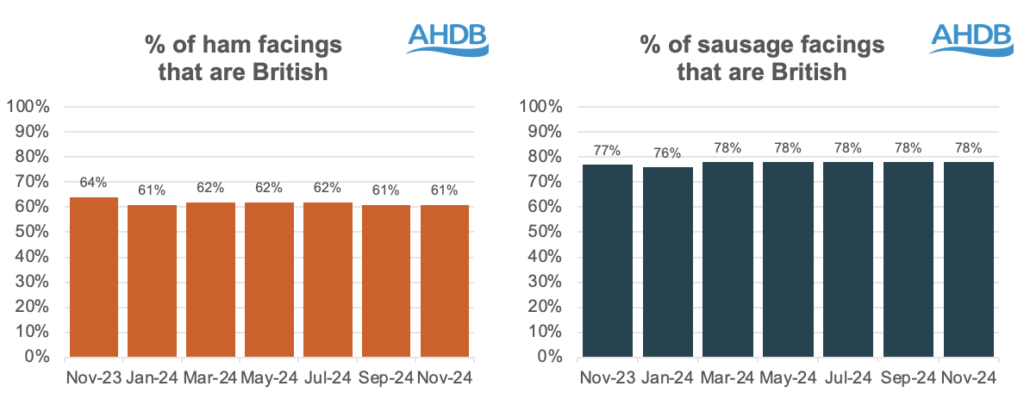

The general ham determine of 61% was consistent with September however down on November 2023, with M&S (99%), Co-op (95%) and Waitrose (90%) main the way in which. The worst performers had been Morrisons, 38%, Asda and Lidl, each on 33%, and Iceland, 13%.

For sausage, total 78% was British, consistent with September and barely up on a 12 months in the past, with M&S (99%), Aldi (98%), Waitrose (97%) and Lidl (90%) the most effective backers of British. Iceland, inevitably, was the bottom, on 44%, with all remaining retailers stocking no less than 69% British.

Retail volumes

Retail pigmeat volumes noticed a 2.9% lower within the 12 weeks to December 1 2024, equal to six,227 tonnes lower than the identical interval in 2023, Kantar information, summarised by AHDB exhibits,

This resulted in spend on pigmeat declining by 1.8% year-on-year regardless of a slight improve in common costs paid (+1.2%). Pork was the one purple meat to say no year-on-year.

Volumes of processed pigmeat drove this total decline, with volumes bought 4.6% down 12 months on 12 months over this era. Burgers and grills had been the one processed lower to see quantity progress (+0.2%) as a consequence of a rise in customers and the frequency of their buy.

Nonetheless, main cuts, the place British pigmeat is strongest, noticed volumes bought improve 1.1% this era, helped by common costs paid lowering by 0.6% year-on-year.

Complete roasting volumes had been 5.8% up over the interval, pushed by will increase in leg (8.7%) and loin (20.3%) gross sales.

All roasting classes noticed common costs lower on this interval, and promotional exercise was seen to enhance efficiency most notably for loin, in keeping with AHDB. Pork ribs additionally noticed progress (+16.1%) as a consequence of a mix of elevated shopper numbers and volumes bought per procuring journey. Mince noticed a 5.0% progress, with a rise in promotional purchases boosting quantity gross sales.

Added worth volumes bought improve by 13.1%, pushed by sous vide (+12.2%), whereas elevated promotional exercise for marinades attracted in new customers leading to a 23.4% improve in volumes bought. Able to cook dinner (+1.9%) benefitted from elevated frequency of buy and volumes bought per procuring journey, AHDB reported.