A 4% rise in UK pork manufacturing final yr helped hold import ranges comparatively secure, regardless of decrease EU costs, though import volumes did choose in ultimate quarter of 2024. The elevated availability of UK pork merchandise didn’t translate into larger export volumes, nevertheless.

The UK imported 789,300 tonnes of pig meat (together with offal) in 2024, up by 1%, 7,500t, on 2023, though month-to-month volumes have fluctuated throughout the yr. There stays some seasonality to pig meat imports, with volumes usually choosing up forward of peak demand durations similar to Christmas, AHDB analyst Freya Shuttleworth famous.

Nevertheless, as EU pig costs fell considerably, whereas UK costs solely noticed marginal motion, This fall 2024 imports had been up 2.7% in comparison with This fall 2023, with each October and December recording year-on-year will increase of simply over 4%,whereas November recorded nearly no change in comparison with 2023. “This implies, that regardless of cheaper EU imports, demand for home product was sustained, probably supported by British retail facings,” Ms Shuttleworth stated.

Over the complete yr, quantity declines in bacon (-2.2%) and processed pig meat (-7.0%) had been outweighed by development in sausage (+4.8%) and contemporary & frozen pork (+2.4%).

Recent & frozen pork accounted for 43% of complete pig meat import quantity at 339,400 tonnes, with Denmark, Germany, Spain and Belgium the important thing suppliers. Bacon makes up the second largest share of import quantity (22%) at 176,500 tonnes. Over 100,000 tonnes of complete bacon imports got here from the Netherlands, with Denmark making up a lot of the remaining quantity.

For sausages and processed pigmeat, Poland and Eire are key suppliers, alongside Germany and Spain. Sausage quantity development has been pushed by elevated shipments from Germany, Eire and Italy, whereas volumes from different key gamers remained secure year-on-year. Nevertheless, quantity decline in processed pig meat has been seen throughout all suppliers.

Exports

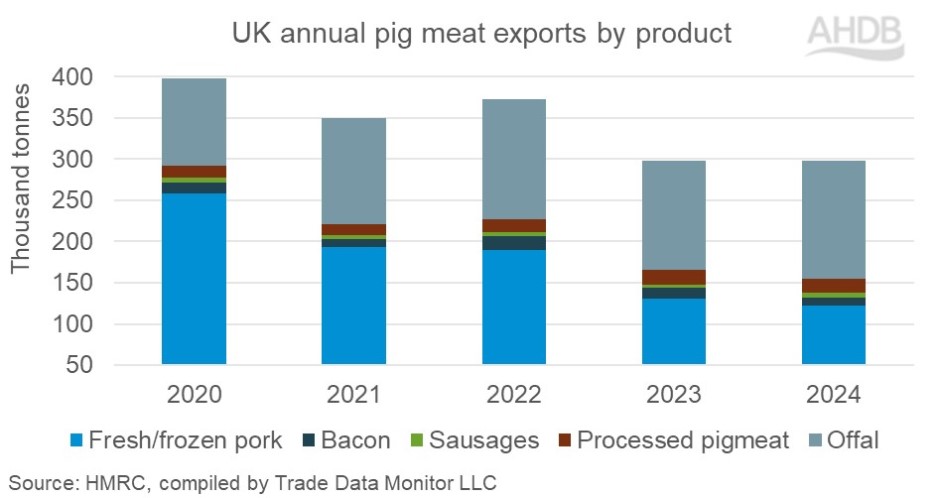

The UK exported 298,100 tonnes of pig meat (together with offal) in 2024, a marginal decline of simply 0.1%, 400t on 2023, regardless of the 4% development in UK pig meat manufacturing volumes. “Home pig costs held agency by means of 2024, regardless of exterior market stress, making UK product much less aggressive on the worldwide market,” Ms Shuttleworth added.

Shipments of offal continued to document vital development, up 9,300t yearly. Export volumes of processed pigmeat and sausage additionally elevated, however from a a lot smaller base. Nevertheless, sturdy declines in contemporary & frozen pork and bacon, down 8,000 tonnes and three,200 tonnes respectively, tipped the general stability.

The EU stays the UK’s largest vacation spot for pig meat exports, accounting for 42% of complete quantity (124,900t). Nevertheless, volumes have slipped year-on-year (-6,400t) as EU manufacturing good points and weaker consumption throughout the continent have impacted import demand for the area. Eire, Germany, the Netherlands, France and Belgium account for 90% of UK shipments to the EU, with virtually half of this made up of contemporary & frozen pork.

Regardless of a stagnant Chinese language financial system, UK shipments to China have grew 7% year-on-year to 120,100t. This development has been pushed by offal, which make up 65% of complete cargo quantity, whereas, shipments of contemporary & frozen pork have continued to say no, down 10% in comparison with 2023. The re-listing of two UK crops earlier than Christmas might additional assist UK pig meat exports to China in 2025, Ms Shuttleworth added.

The Philippines continues to be a profitable marketplace for UK exports. In 2024, pig meat shipments elevated by 3,100t to twenty,400t, with volumes primarily made up of offal (77%).

“The UK advantages from diminished tariff charges on pig meat shipments to the Philippines, a measure launched by the Philippine authorities to safe provides and hold shopper meals prices down whist the home pork trade battles with African swine fever,” Ms Shuttleworth stated.

“Different key locations of UK pig meat exports are the US, South Africa, Dominican Republic, South Korea and Cote d’Ivoire. Except for the US and South Africa, which obtain a very good proportion of contemporary & frozen pork, the overwhelming majority of product going to those various locations is offal.”