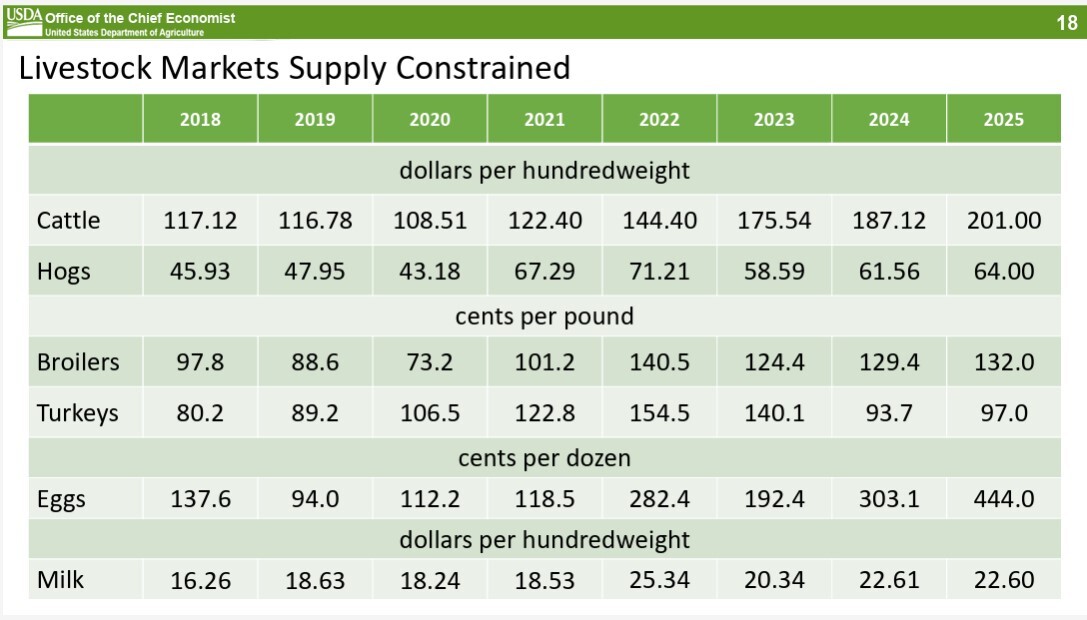

Livestock pricing expectations, together with a concentrate on the layer & egg market

In his 2025 Agricultural Outlook Discussion board presentation, USDA Chief Economist Seth Meyer supplied insights into the present developments and challenges dealing with the livestock trade, with a selected concentrate on the egg market.

Meyer’s evaluation highlighted ongoing herd contractions within the cattle sector, productiveness shifts in swine manufacturing, and the continued battle of the egg trade to get well from repeated Extremely Pathogenic Avian Influenza (HPAI) outbreaks.

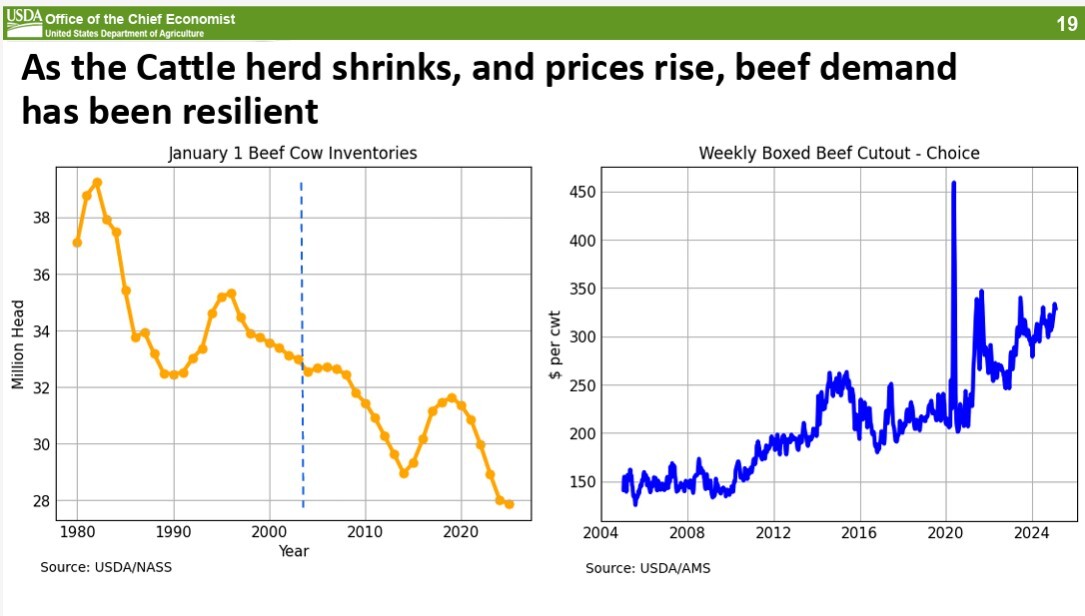

Beef market: Shrinking herd and robust demand

Meyer famous that the cattle herd has been in a contraction part for a number of years. Regardless of report feeder cattle costs, farmers should not but retaining sufficient calves to show the cycle round.

“The cattle herd continues to shrink. My NASS colleagues produced a report in January, thought that possibly when you’ve gotten report feeder costs that you simply may begin to flip, we’re not there but,” Meyer said.

The mix of shrinking home provides and sturdy client demand has pushed beef costs greater.

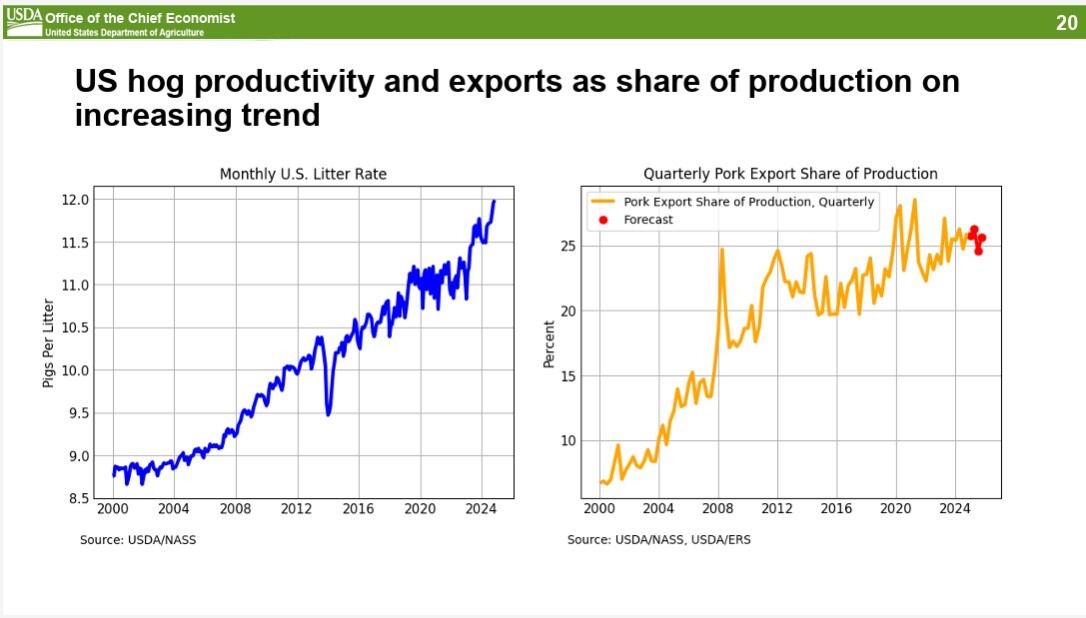

Pig market: Rebounding productiveness and export progress

Within the swine sector, Meyer pointed to a big enchancment in productiveness following a interval of sluggish positive factors, notably in pigs per litter.

Throughout and shortly after COVID, Meyer mentioned the US trade noticed a fall in pigs per litter.

“The trade has improved its productiveness. We now have seen that productiveness bounce, maybe to pattern from earlier than, maybe sooner than pattern,” he mentioned. “We’ll see the way it pans out over time. On the identical time, the export share of manufacturing has elevated.”

Moreover, the trade has benefited from declining feed costs, easing among the price pressures on producers.

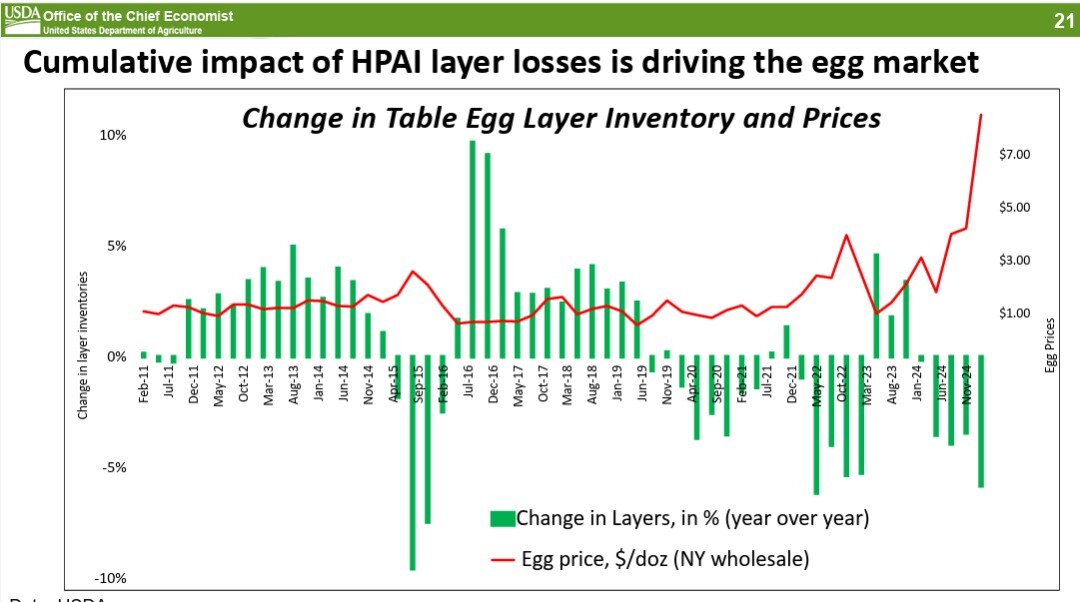

Egg market: The impression of HPAI on provide and costs

The egg trade stays one of the vital affected segments of the livestock market, with repeated HPAI outbreaks severely lowering the layer flock inhabitants. Meyer emphasised the distinctive nature of the present disaster in comparison with previous occasions.

“In 2015, you had the chance to rebuild that layer flock in very quick order,” he mentioned. “You had the chance to place extra layers again in, convey provide again as much as a stage which might alleviate costs.”

Nonetheless, the continued nature of HPAI has prevented related restoration efforts.

At present, the U.S. layer flock stands at roughly 291 million birds, properly under the popular 320-325 million.

Meyer underscored the gravity of the scenario: “We want a possibility to get these egg costs down, to have HPAI not repeatedly hit, and to have the ability to rebuild these layer flocks.”

Shopper value implications

Egg markets are notably inelastic, that means that customers have few alternate options when costs rise.

“Shoppers, whereas they might not like the value of eggs, there should not many alternate options to the acquisition of eggs,” Meyer identified.

This lack of substitutes amplifies the impression of provide disruptions, making value volatility a important concern.

Meyer additionally highlighted how the latest losses within the layer flock have prolonged the interval of elevated egg costs.

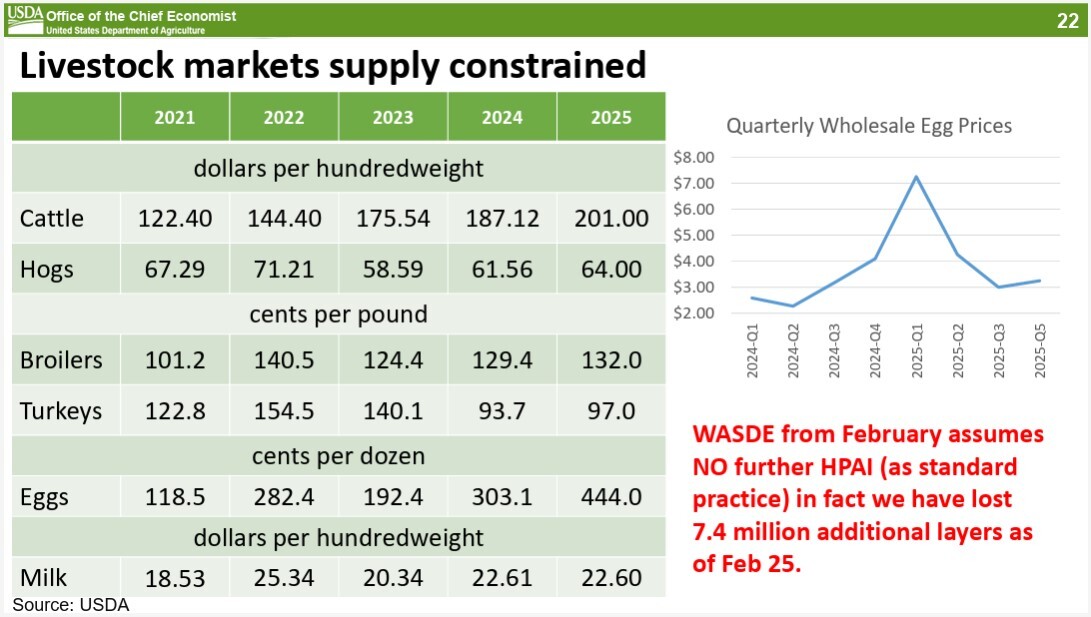

“Simply for the reason that February forecast, we have now misplaced one other 7.4 million layer birds. We will add on the size of 4 to 6 million again into the flock,” he defined.

Nonetheless, these numbers point out that rebuilding efforts are lagging behind losses, that means value reduction could take longer than anticipated.

Transferring ahead, Meyer acknowledged the issue in forecasting the egg market given the unpredictability of HPAI. The USDA’s quarterly egg value estimates assume no future outbreaks.

However Meyer acknowledged the uncertainty in that assumption: “The trick is what do you have to assume? What quantity ought to we assume in depopulations?”

The absence of a transparent reply makes long-term projections notably difficult.

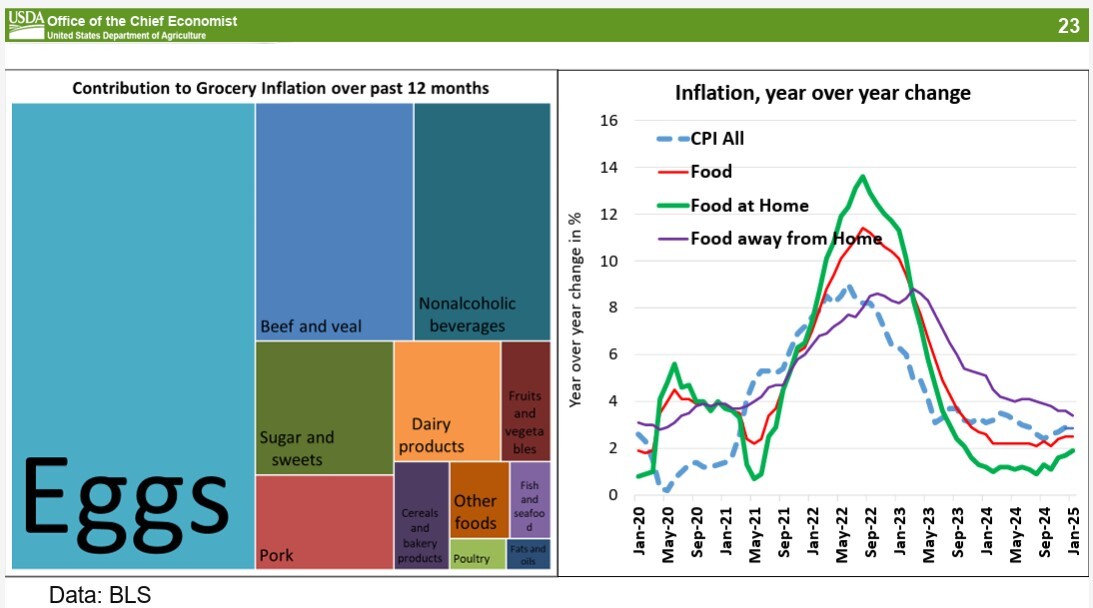

Regardless of these challenges, Meyer pointed to broader developments in meals value inflation, displaying that whereas general meals value will increase have moderated, eggs proceed to be a serious driver of inflation.

“That egg field is mainly half,” he famous. “On the dairy facet, we have got flat milk costs into the subsequent yr. We have seen a few of our decline in product costs giving us a bit of enhance into the export market.”

He instructed that the dairy market is getting a bit of bit extra aggressive. From a home profitability perspective, the feed ratio is staying even with flat costs, so “possibly profitability will enhance into the approaching yr.”

Meyer’s 2025 livestock outlook painted a fancy image for the trade. Whereas some sectors, like swine, are displaying indicators of restoration, others, such because the cattle, layer and egg markets, proceed to battle with provide constraints and value pressures. The egg market, specifically, faces ongoing disruptions as a result of HPAI, making value reduction troublesome to foretell. Market dynamics and illness administration will likely be important elements shaping the this yr’s US livestock manufacturing.